SCHD Dividend Calculator

Project long-term growth with dividend reinvestment.

Projected Results

Enter your investment plan to see your projection.

SCHD Dividend Calculator – Maximize Your Passive Income from Schwab U.S. Dividend Equity ETF

If you’re looking to build long-term passive income through dividends, the SCHD Dividend Calculator is your ultimate tool. With this calculator, you can estimate your potential returns from one of the most popular dividend-paying ETFs in the U.S. – the Schwab U.S. Dividend Equity ETF, also known by its ticker symbol SCHD.

In this detailed guide, we’ll cover everything you need to know about using the SCHD Dividend Calculator to project your dividend income, calculate growth over time, and make smart investment decisions. Whether you’re a beginner investor or a seasoned income strategist, understanding your dividend potential is key.

What is SCHD?

SCHD stands for Schwab U.S. Dividend Equity ETF, an exchange-traded fund that focuses on high-quality U.S. companies with a strong history of paying dividends. Launched in 2011 by Charles Schwab, this ETF has become a favorite among dividend growth investors.

Key highlights:

Ticker Symbol: SCHD

Dividend Yield: ~3%–4%

Expense Ratio: 0.06% (very low)

Holdings: Large-cap companies like PepsiCo, Coca-Cola, Verizon, and more

Dividend Frequency: Quarterly

Because SCHD pays consistent dividends and has a history of increasing payouts, it’s an excellent candidate for dividend-focused investment strategies.

What is a SCHD Dividend Calculator?

The SCHD Dividend Calculator is a tool that helps you forecast the dividend income you can earn from investing in SCHD. It allows you to input the amount of money you plan to invest, the current share price, dividend yield, expected growth rate, and investment period.

It provides outputs such as:

Initial number of shares purchased

Estimated annual and quarterly dividend income

Cumulative dividends over time

Option to include DRIP (dividend reinvestment plan)

This calculator is ideal for long-term planning, retirement strategies, and passive income forecasting.

Why Use an SCHD Dividend Calculator?

Using an SCHD Dividend Calculator provides several benefits:

1. Forecast Long-Term Returns

You can project how much income your SCHD investment will generate over time, even 10, 20, or 30 years down the line.

2. Understand the Power of Reinvestment

With DRIP enabled, your dividends are reinvested to buy more SCHD shares, leading to compound growth. This can significantly increase your overall earnings.

3. Make Informed Investment Decisions

Knowing how much income to expect allows you to set realistic financial goals, such as replacing a portion of your salary or funding early retirement.

4. Compare Scenarios

By adjusting the input values, you can compare different strategies (e.g., investing more upfront vs. contributing monthly) and see their impact on your future income.

Key Inputs of the SCHD Dividend Calculator

To get accurate results, the SCHD Dividend Calculator typically requires the following inputs:

| Input Field | Description |

|---|---|

| 💰 Investment Amount | Total capital you plan to invest |

| 📉 Current Share Price | Price of one SCHD share (e.g., $75) |

| 📈 Dividend Yield (%) | Annual dividend yield (e.g., 3.5%) |

| 🔁 Dividend Growth Rate | Estimated yearly increase in dividend payouts (e.g., 5%) |

| 📆 Investment Duration | Number of years you plan to hold the investment |

| ♻️ Reinvest Dividends | Option to reinvest dividends automatically (DRIP) |

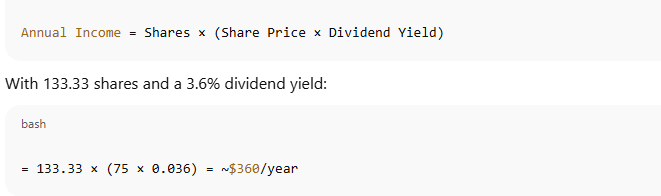

How the SCHD Dividend Calculator Works

🔹 Step 1: Calculate Initial Shares

First, it calculates how many SCHD shares you can purchase:

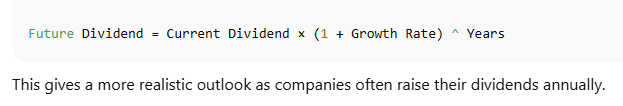

🔹 Step 3: Projected Growth Over Time

If the dividend grows annually at, say, 5%, the calculator uses compound growth:

🔹 Step 4: Include Reinvestment (DRIP)

With DRIP turned on, the calculator assumes dividends are used to buy more shares, compounding your returns year after year.

This effect can significantly increase your holdings and total income by the end of the investment period.

Sample Output from SCHD Dividend Calculator

Let’s assume:

Investment Amount: $10,000

Share Price: $75

Dividend Yield: 3.6%

Dividend Growth Rate: 5%

Investment Duration: 10 years

DRIP: Enabled

🔸 Without DRIP

Initial Shares: 133

Annual Dividend (Year 1): $360

10-Year Cumulative Dividends: ~$4,718

🔸 With DRIP Enabled

Initial Shares: 133

Reinvested shares over time: ~163 (end of 10 years)

10-Year Cumulative Dividends: ~$6,295

The difference clearly shows the power of compounding with DRIP.

Use Cases of SCHD Dividend Calculator

✅ Long-Term Investing

Investors aiming for early retirement or financial independence can use this calculator to track progress toward their income goals.

✅ Passive Income Planning

You can determine how much to invest now to generate a specific monthly or yearly dividend income in the future.

✅ Comparing Investment Options

Compare SCHD with other ETFs, REITs, or stocks by calculating dividend income potential across different assets.

Tips for Maximizing SCHD Dividend Returns

Reinvest Dividends Early

Start with DRIP to take advantage of compound growth.Invest Consistently

Regular contributions (monthly or quarterly) boost long-term income.Diversify Smartly

SCHD is solid, but pairing it with other dividend ETFs can reduce risk.Track Dividend Increases

SCHD has a history of increasing payouts. Monitor the growth annually.Monitor Expenses & Taxes

While SCHD has a low expense ratio, always factor in tax impacts on dividends.

Limitations of the SCHD Dividend Calculator

While the calculator offers great projections, it’s based on assumptions. Here are a few limitations:

Past performance ≠ future performance

Dividend growth is not guaranteed.Tax implications vary

The calculator may not include taxes on dividend income.Market fluctuations

Share price changes can affect DRIP effectiveness.Yield can change

Current yield is not fixed; it fluctuates with stock price and payouts.

Despite these limitations, the calculator is a reliable planning tool when used with realistic expectations.

Why SCHD is a Popular Dividend ETF

SCHD stands out in the dividend investing world due to:

Strong dividend history

High-quality holdings

Low management fees

Quarterly payouts

Consistent dividend increases

It’s often recommended in retirement portfolios and by FIRE (Financial Independence, Retire Early) investors due to its reliable returns and compounding potential.

Where to Use the SCHD Dividend Calculator

You can use this calculator on various platforms:

📱 Personal Finance Blogs

💼 Retirement Planning Websites

🧾 ETF Tracking Tools

🧮 Investment Education Portals

🖥️ Your Own Website (embed with HTML/JavaScript or WordPress shortcode)

Would you like an embeddable version or a calculator plugin for WordPress? Just ask!

Final Thoughts

The SCHD Dividend Calculator is a must-have tool for anyone serious about dividend investing. It gives you clear insights into how much passive income you can generate over time, whether you’re investing $1,000 or $100,000.

By calculating your estimated income, projecting growth with DRIP, and modeling your long-term goals, you can plan a smarter financial future. The calculator helps eliminate guesswork and adds precision to your dividend strategy.

Start using the SCHD Dividend Calculator today and unlock the true potential of passive income!

Frequently Asked Questions (FAQs)

❓ What is the SCHD Dividend Yield?

As of 2025, SCHD typically offers a yield between 3.2% and 3.8%, but it varies with the market and company earnings.

❓ How often does SCHD pay dividends?

SCHD pays quarterly dividends, typically in March, June, September, and December.

❓ Is dividend income from SCHD taxable?

Yes, dividends from SCHD are taxable, even if reinvested. Consult a tax professional for detailed advice.

❓ Is the calculator free?

Yes, most SCHD Dividend Calculators online are free to use. You can also embed your own version on a blog or finance site.